Have you seen the movie, Hachi? The movie is about a professor and his dog. The professor dies, and the dog, Hachi, waits for 8 years before breathing his final goodbye to his favourite hooman at the train station, hoping he will come and hug him. The movie showcases the undying spirit of loyalty and the beautiful bond between dogs and humans.

But you must be wondering why I am bringing an utterly emotional movie amid a blockchain-related article. What’s the relation between the movie, its character, and the article?

I’ll share it with you!

Hachi represents the entire dog specie in the movie. Likewise, asset tokenization refers to the process of representing physical or intangible assets such as real estate, commodities, or art, which are converted into digital tokens on a blockchain network. This allows for the fractional ownership and transfer of assets, making it possible for individuals and institutions to invest in a wider range of assets, regardless of location or financial status. These tokens can be auctioned, bought, sold, and traded just like any other cryptocurrency, but they also represent ownership or a stake in the underlying asset. Asset tokenization aims to increase accessibility, efficiency, and security in investment and asset management.

Basics of Asset Tokenization

Asset tokenization allows for the easy and efficient transfer of ownership and representation of assets on the blockchain. This can significantly simplify and streamline the buying and selling of assets, as well as enable new forms of investment and financing. In addition, tokenization helps upgrade the infrastructure and increase the collateral in the financial market. Asset tokenization has the potential to revolutionize the way assets are bought, sold, and traded, providing a more secure, transparent, and efficient way to invest in real-world assets.

Asset tokenization on blockchain uses smart contracts, which are self-executing contracts with the terms of the agreement written into code.

Smart contracts can automate buying and selling assets, the need for manual processes and minimizing the risk of errors or fraud. Smart contracts can also be used to buy and sell real estate assets, automating the process and minimizing the risk of errors or fraud. This can greatly streamline buying and selling real estate and make it more accessible and efficient for both buyers and sellers.

Gone are the times when businesses have to explain the benefits of using blockchain and distributed ledger technology (DLT) in financial markets. Market players in every sector are aware of it if they are not already jumping on the bandwagon of tokenizing their assets. For example, Swiss Bank Cité Gestion becomes the first private bank to tokenize its shares.

Now that we know what asset tokenization is, let’s see why asset tokenization is necessary.

Why Is Asset Tokenization Necessary?

Asset tokenization has the potential to increase liquidity and accessibility for certain types of assets. For example, it could allow for the fractional ownership of high-value assets such as art or collectibles, which may not be practical to buy or sell in their entirety.

Here are the reasons why asset tokenization is necessary:

Increased Accessibility : By converting traditional assets into digital tokens, asset tokenization allows for the creation of smaller, more manageable units of ownership, making it possible for individuals and institutions to invest in a wider range of assets, regardless of location or financial status. This increased accessibility can increase the market’s overall liquidity as more people can invest in a broader range of assets.

Efficiency : Asset tokenization eliminates the need for intermediaries, reducing costs and increasing the efficiency of transactions. By using smart contracts, the rules for an asset can be encoded into a blockchain network, enabling the automatic execution of predefined rules and reducing the need for manual intervention. Also, it ensures deep liquidity of assets and facilitates easy entry and exit of investors at any point.

Security : Asset tokenization provides a secure and transparent way to invest in assets. By using blockchain technology, all parties have access to the same information, and the rules for the asset are transparent and unalterable. This helps to reduce the risk of fraud and increase the security of transactions.

New Investment Opportunities : Asset tokenization can revolutionize traditional investment models, as it allows for creating new asset classes and establishing new investment opportunities. This can provide new opportunities for growth and diversification for individuals and institutions. It also makes buying assets like real estate, art collectibles, and so on affordable, which otherwise wouldn’t have been possible.

What Are the Different Types Of Asset Tokenization?

Asset tokenization refers to converting ownership rights of physical or intangible assets into digital tokens on a blockchain platform. These digital tokens can be used to represent ownership or fractions of ownership of the underlying assets. Based on the nature of the assets being tokenized, there are three main categories of asset tokenization: tangible assets, fungible assets, and non-fungible assets. And, on the basis of speculation, there are currency tokens, utility tokens, and security tokens.

Tangible Assets : Tangible assets refer to physical assets like real estate, commodities, or artwork. Tokenizing tangible assets makes trade and transfer ownership rights easier while providing greater transparency, security, and liquidity. Real estate tokenization is an excellent example of this, where a property is divided into smaller fractions, each represented by a token.

Fungible Assets : Fungible assets are interchangeable and identical, like currency or stocks. Tokenizing these assets creates a more efficient, cost-effective, and secure way of conducting transactions. Tokenized stocks, for instance, are becoming increasingly popular in the financial sector, as they allow for easier and faster trades with lower fees compared to traditional stock exchanges.

Non-fungible Assets : Non-fungible assets are unique and cannot be replaced or exchanged for an equal value. Examples of non-fungible assets include rare collectibles, artwork, or even virtual real estate in online gaming platforms. Non-fungible tokens (NFTs) are being used to represent ownership of these assets, making it easier to verify authenticity and ownership while providing a more secure and transparent way of tracking and trading these assets.

On the Basis of Speculation

- Currency Tokens : Currency tokens are digital assets that substitute for traditional currencies such as fiat money or commodities such as gold. These tokens are designed to maintain a stable value and can be used to purchase goods and services.

- Utility Tokens : Utility tokens are designed to provide access to a specific service or product within a particular ecosystem. These tokens are typically used for accessing a specific application or platform. For example, a token for a video streaming service can be used to pay for monthly subscriptions or access premium content.

- Security Tokens : Security tokens are digital representations of traditional securities such as stocks, bonds, or real estate. They are designed to offer financial returns to their holders through investments in the underlying assets. These tokens are subject to regulatory oversight and must comply with securities laws.

The type of token chosen will depend on the intended use and the regulatory framework applicable to the asset being tokenized. Each type of token offers unique benefits and has its own risks and considerations. Understanding the nature and implications of these tokens is crucial to ensuring a successful tokenization project.

Example Of Asset Tokenization In Blockchain

Asset tokenization is a promising technology that has the potential to transform the financial industry by increasing accessibility, efficiency, and security in investment and asset management. It digitizes tangible assets, such as real estate, into digital tokens on a blockchain network. By allowing for the fractional ownership and transfer of real-world assets, real-world asset tokenization can democratize investment and create new opportunities for individuals and institutions alike.

A great example of asset tokenization on the blockchain is the tokenization of real estate assets, also known as real-world asset tokenization. In this case, a real estate property is represented as a digital token on the blockchain, which can be bought, sold, and traded like any other cryptocurrency. The token represents ownership or a stake in the property and can be easily transferred between parties without the need for traditional intermediaries such as real estate agents or brokers.

With the increasing popularity of crypto and blockchain, tokenized assets have become a major focus for many projects. For example, a consortium of 12 banks, including Bank of America and Citi, are experimenting with tokenizing liabilities to achieve faster settlements.

In November of last year, DBS Bank, JP Morgan, and SBI Digital Asset Holdings conducted foreign exchange and government bond transactions using tokenized Singapore Government Securities Bonds, Japanese Government Bonds, JPY, and SGD via the Ethereum L2 network, Polygon.

This shows the growing trend of major financial institutions adopting tokenized assets and using L2 for scaling. The DeFi project MakerDAO is also delving deeper into real-world assets, having recently voted to allow mortgage loans on commercial real estate properties through a partnership with Huntingdon Valley Bank (HVB).

WisdomTree recently launched its Short-Term Treasury Digital Fund (WTSY), digitizing its fund share ownership record on Ethereum or Stellar blockchains, signaling a step forward in bringing traditional financial assets into the digital world.

Real-world asset tokenization is touted to be a promising area of growth in 2023, and we’d see its real-life implications in the future.

Asset Tokenization Vs. Securitization Vs. Fractional Ownership

| Asset tokenization | Securitization | Fractional Ownership | |

|---|---|---|---|

| Ownership | Involves representing ownership or a share of an asset as a digital token on a blockchain. The token represents ownership or a share in the underlying asset and can be bought, sold, and traded just like any other digital asset. | Involves pooling together assets, such as loans or mortgages, and issuing securities backed by those assets. It has been commonly used in traditional finance for decades. | Ownership of an asset, such as a property or a piece of art, is divided into smaller portions, allowing multiple investors to own a share of the asset through tokenization or traditional means such as co-ownership or timeshare arrangements. |

| Ease Of Ownership | Enables secure and transparent transfer of ownership. | Issuance of securities representing ownership or a claim on the cash flows generated by the underlying assets. Securities are then sold to investors. | Enables individuals to own a portion of an asset that may be too expensive to purchase outright. |

| Investment Opportunities | Offers new investment opportunities and liquidity for previously illiquid assets. | Helps diversify risk and create new investment opportunities. | Offers new investment opportunities and access to previously inaccessible assets such as private jets, yachts, and high-end real estate. |

| Market Size | According to a report by Global Market Insights, the asset tokenization market size was valued at USD 2.6 billion in 2020 and is projected to grow at a CAGR of more than 20% from 2021 to 2027 | According to Grand View Research, the fractional ownership market size will reach $2.67 billion by 2027, growing at a compound annual growth rate of 26.1% from 2020 to 2027. The report also notes that the increasing demand for alternative investment options, and the growth of the sharing economy, are driving the growth of the fractional ownership market. | The size of the securitization market varies over time and is influenced by macroeconomic conditions, regulatory changes, and investor demand. Due to the complexity and size of the market, it is difficult to estimate an exact market capitalization. |

| Examples | Asset tokenization is used to tokenize real estate, art & commodities, such as gold, silver, oil and so on | Securitization is used in Personal loans, consumer loans, credit card debt and so on | Used to buy high-end real estate, Private Jets, Yachts, pieces of fine art, and so on |

On-Chain Tokenization and Its Rising Prominence

A significant portion of the world’s wealth is tied up in illiquid assets. In a 1997 survey in the US, over 56% of assets held by taxpayers with a net worth of between $600,000 and $1 million were illiquid. These assets are often traded at a discount compared to liquid assets and have lower trading volumes and imperfect price discovery due to a high stock-to-flow ratio. For instance, illiquid physical art assets have a stock-to-flow ratio of 28.3, whereas liquid Real Estate Investment Trusts (REITs) have a ratio of 1.11.

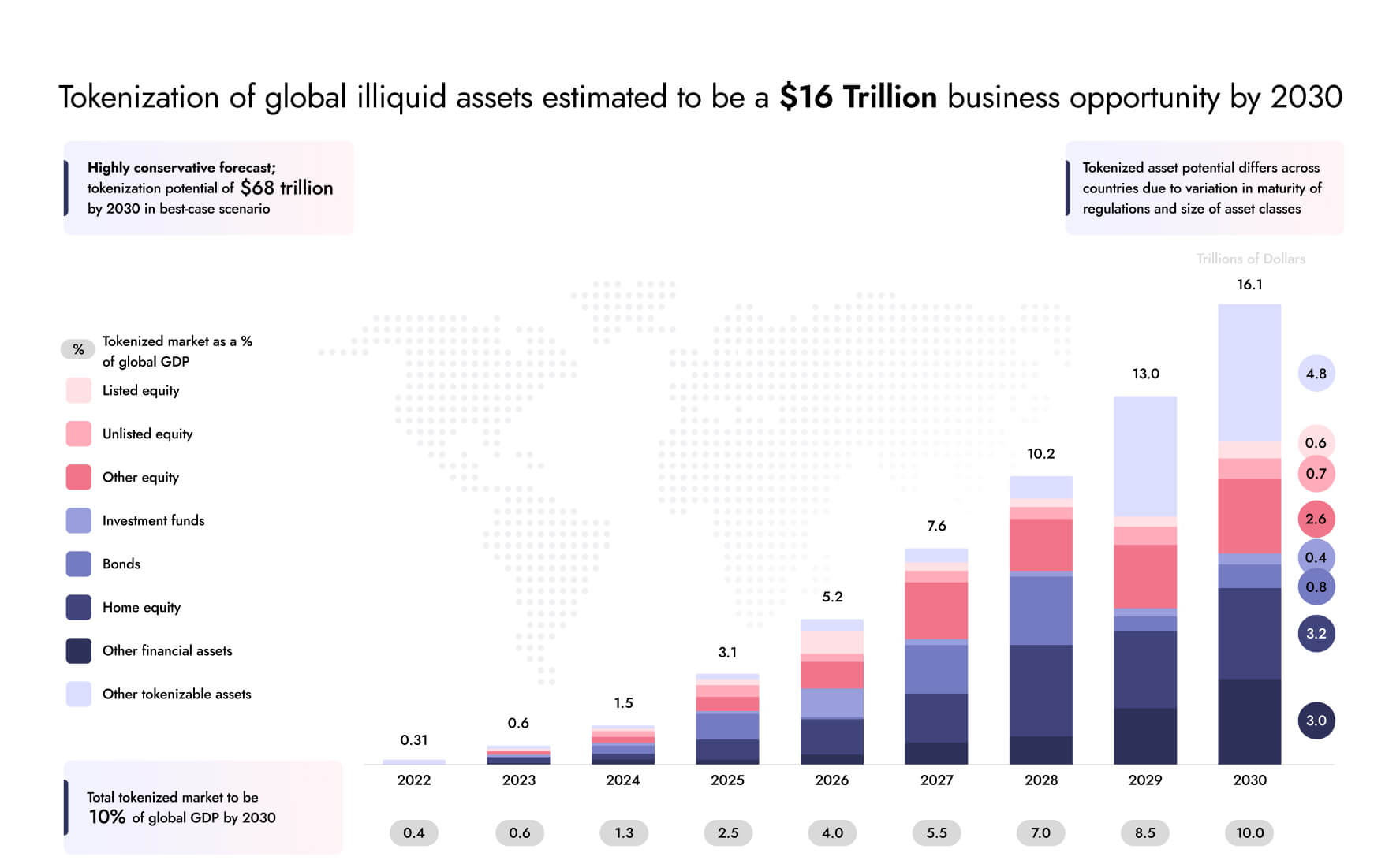

Illiquid assets include real estate, natural resources, commodities, fine art, private equity, and more. Additionally, many asset classes, such as pre-IPO stocks, hedge funds, and commodities, are only accessible to a select group of wealthy investors and institutions due to restrictions on the minimum investment size. It is estimated that the global tokenization of illiquid assets will reach $16 trillion by 2030. And on-chain tokenization will play a pivotal role in growing the economy.

But what is on-chain tokenization?

The process of creating digital tokens stored and managed on a blockchain is referred to as on-chain tokenization. This entails converting the ownership rights of an asset into a digital token that can be traded and transferred on the blockchain. The token symbolizes fractional ownership of the underlying asset, enabling the creation of new investment opportunities and easier access to assets.

On-chain tokenization brings various benefits, such as enhanced liquidity, lower costs, improved security, and transparency. By eliminating intermediaries like banks or brokers, the decentralized and automated nature of the blockchain cuts down on transaction costs, leading to a more efficient investment experience for investors.

Moreover, on-chain tokenization provides a tamper-proof, unalterable, and transparent record of ownership. Storing ownership information on the blockchain creates a secure and transparent record of asset ownership, reducing the risk of fraud, making it easier to track and transfer ownership, preventing disputes, and providing a more secure investment experience for all involved parties.

On-chain asset tokenization is often used in conjunction with smart contracts, self-executing contracts with the terms of the agreement written into code. Smart contracts can be used to automate the process of buying and selling assets, reducing the need for manual processes and minimizing the risk of errors or fraud. With that said, on-chain asset tokenization has the potential to revolutionize the way we buy, sell, and trade a wide range of assets. It is already being applied to various industries including real estate, finance, and even art and collectibles.

Physical Assets Tokenization and Its Need

Tokenizing physical assets like real estate, artworks such as paintings, sculptures, photographs, physical commodities such as gold, silver, oil, and other precious metals, and collectibles such as vintage cars, stamps, etc., refers to the process of creating a digital representation of a physical asset and assigning it a unique identifier, often in the form of a token on a blockchain. Tokenization can provide numerous benefits for individuals and businesses, including increased efficiency, transparency, greater liquidity, reduced costs, improved security, and increased accessibility for buying and selling assets.

Tokenization creates a more efficient and transparent market for asset buying and selling. Traditional buying and selling of physical assets can be cumbersome and time-consuming, requiring the transfer of ownership through physical documents and intermediaries. Tokenization streamlines this process by allowing the transfer of ownership to be recorded and verified on a blockchain, making the process faster and more secure.

Additionally, tokenization can create new financial instruments and investment opportunities, such as the ability to trade or borrow against the asset’s value. This can provide new funding sources for businesses and individuals and increase the asset’s value.

Tokenization can also enable the creation of fractional ownership of an asset, allowing multiple parties to own a portion of the asset and potentially increasing access and liquidity. For example, tokenization could allow someone to own a small percentage of a piece of real estate rather than having to purchase the entire property.

How does asset tokenization work?

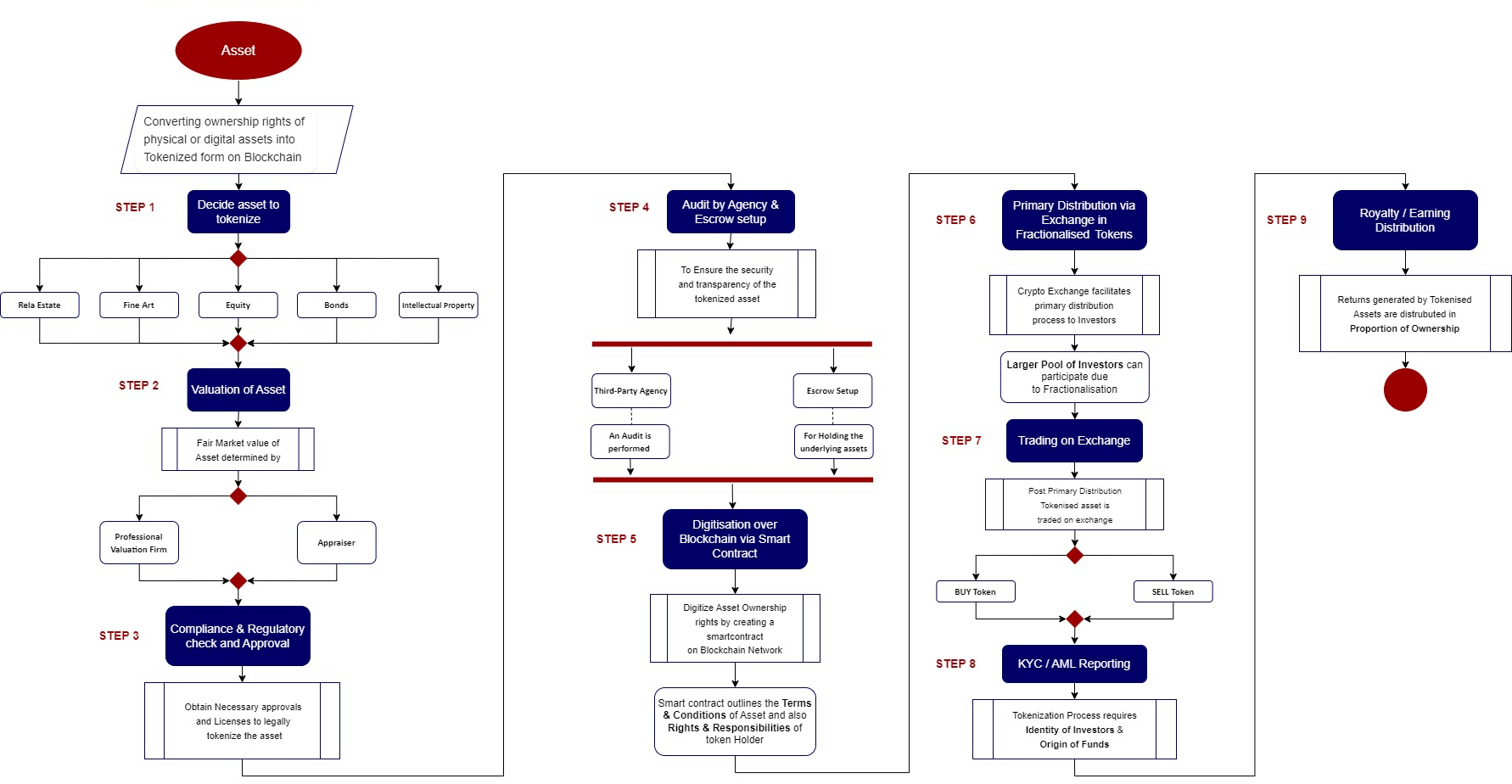

Asset tokenization converts ownership rights of physical or digital assets into a secure, tokenized form on a blockchain network. The following are the critical steps involved in the process of tokenizing an asset:

1. Decide asset to tokenize : The first step is to decide which asset you want to tokenize. It can be any tangible or intangible asset, such as real estate, fine art, equity, bonds, or intellectual property.

2. Valuation of asset : The next step is determining the asset’s value to be tokenized. A professional valuation firm or an appraiser can help determine the asset’s fair market value.

3. Compliance and regulatory check and approval : Asset tokenization requires compliance with relevant regulatory and legal frameworks. This step involves obtaining the necessary legal approvals and licenses to tokenize the asset.

4. Audit by the agency and Escrow setup for asset holding : To ensure the security and transparency of the tokenized asset, an audit is performed by a trusted third-party agency, and an escrow is set up for holding the underlying asset.

5. Digitization over blockchain via smart contract : The next step is to digitize the asset ownership rights by creating a smart contract on the blockchain network. The smart contract outlines the terms and conditions of the tokenized asset, including the rights and responsibilities of the token holders.

6. Primary distribution via exchange in fractionalized tokens : The tokenized asset is then distributed to investors through a primary distribution process, which is usually facilitated by a cryptocurrency exchange. The asset is offered to investors in the form of fractionalized tokens, allowing a larger pool of investors to participate.

7. Trading on exchange : Once the primary distribution is completed, the tokenized asset is available for trading. Investors can buy and sell the tokens to realize a profit.

8. KYC/AML reporting : To comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, the tokenization process requires reporting on the identity of the investors and the origin of funds.

9. Royalty/Earning distribution to all holders : Finally, the tokenized asset generates a return in the form of royalties or earnings, which are then distributed to all the token holders in proportion to their ownership.

These steps ensure that the tokenized asset is secure, transparent, and accessible to a wider pool of investors while complying with the relevant regulations and legal frameworks.

And that’s all about asset tokenization, its future implications, and how it works. In the following article, we will share another comprehensive blog on the factors to consider for asset tokenization, its benefits, and so on. Stay tuned!

mobifinxadmin