In part 1, we’ve learnt what is asset tokenisation, its potential and different types of asset tokenization on blockchain.

Let’s learn what do you need to tokenize assets, industries incorporating asset tokenization and a lot more.

Prerequisites for tokenizing assets

The prerequisites for tokenizing assets can vary depending on the asset type and the jurisdiction in which the tokenization is taking place. However, some common prerequisites for asset tokenization include:

Asset ownership : The owner of the asset must have clear and legally valid ownership rights over the asset they wish to tokenize

Due diligence : Thorough due diligence must be performed on the asset and the tokenization process, to ensure that the asset is appropriate for tokenization and that the tokenization process complies with all relevant laws and regulations.

Technical infrastructure : Tokenization requires a secure and reliable technical infrastructure, including blockchain technology and smart contract capabilities to support the creation, issuance, and transfer of the tokens.

Legal framework : Asset tokenization must comply with all relevant legal and regulatory frameworks, including securities laws and financial regulations as per desired jurisdiction and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Token standardization : A standard format must be established for the token, which can be traded and recorded on the blockchain. Asset class can be unique and a specific token standards For Example in Ethereum Blockchain ERC-20 is for Utility tokens, ERC 721 is for NFTs, ERC 1400 for Security Tokens.

Custodial solutions : Appropriate custodial solutions must be in place to securely hold and manage the tokens, and to ensure the safety and security of the underlying assets.

Marketplace : A robust marketplace with secure infrastructure, either decentralized exchange or centralized platform, is necessary for buying, selling, and trading tokenized assets. This allows for liquidity and transfer of the assets.

What is a tokenisation platform?

A tokenization platform is a technology-based system that facilitates the creation, issuance, and management of digital tokens that represent ownership or a share of an asset. Asset tokenization platforms aim to increase accessibility, liquidity, and fractional ownership of assets on blockchain that are traditionally hard to trade, such as real estate, fine art, and commodities.

A tokenization platform typically includes several key components, such as a blockchain infrastructure, a smart contract system, and an interface for managing and trading tokens. The platform may also include tools for asset management, compliance, and reporting. Asset tokenization platforms use blockchain technology to securely track ownership of digital tokens representing assets. The decentralized ledger enables 24/7 trading without intermediaries, reducing costs and speeding up transactions. Tokenization also enables fractional ownership of assets, allowing multiple parties to own and trade portions of it.

At MobifinX, we’re striving to do the same! We’ve built 8 mighty platforms that would take a crypto enthusiast’s user experience to the next level.

Industries Where Tokenization is Applicable/ Industries That Are Embracing the Concept of Tokenization of Assets

Asset tokenization has the potential to revolutionize the way that a wide range of assets are managed and traded, providing benefits such as increased security, transparency, and liquidity. There are a wide range of industries that are using on-chain asset tokenization on blockchain, including

Real estate : Tokenization of real estate assets can allow for more efficient and transparent transactions and management of properties.

Art and collectibles : Tokenization of art and collectibles can provide a way to authenticate and track ownership of these assets, as well as facilitate more efficient trading.

Commodities : Tokenization of commodities such as gold and oil can provide a more efficient and transparent way to track and trade these assets.

Stocks and securities : Tokenization of stocks and securities can allow for more efficient and cost-effective trading, as well as improved access to financial markets for investors.

Supply chain management : Tokenization of supply chain assets can allow for more efficient tracking and management of goods as they move through the supply chain.

Intellectual property : Tokenization of intellectual property assets such as patents and trademarks can provide a way to authenticate and track ownership of these assets.

Which Factors to Consider Before Entering Token Economy?

The token economy is rapidly growing and has the potential to revolutionize the way we do business. However, before entering this market, it’s important to consider various factors that could impact your success. Let’s check the factors you must consider before entering token economy:

Token Classification : Understanding the nature and characteristics of the token being considered, including any regulations it may be subject to.

Underlying Asset : Assessing the type of asset backing the token and the associated risks.

Token Issuer : Evaluating the credibility and track record of the issuer and the level of regulatory oversight they are subject to.

Token Offering Terms : Carefully reviewing the conditions of the token offering, including the token price, fees, commissions, and potential risks and limitations.

Token Utilization : Determining the intended use of the token and evaluating the demand for it.

Regulatory Landscape : Being aware of the regulatory environment in which the token will be issued and traded, as this field is rapidly evolving.

Investment Risks : Considering the potential risks involved, such as loss of value or fraud, before entering the token economy.

Platform Integration : An easy to use platform which enables you to tokenise your assets safely.

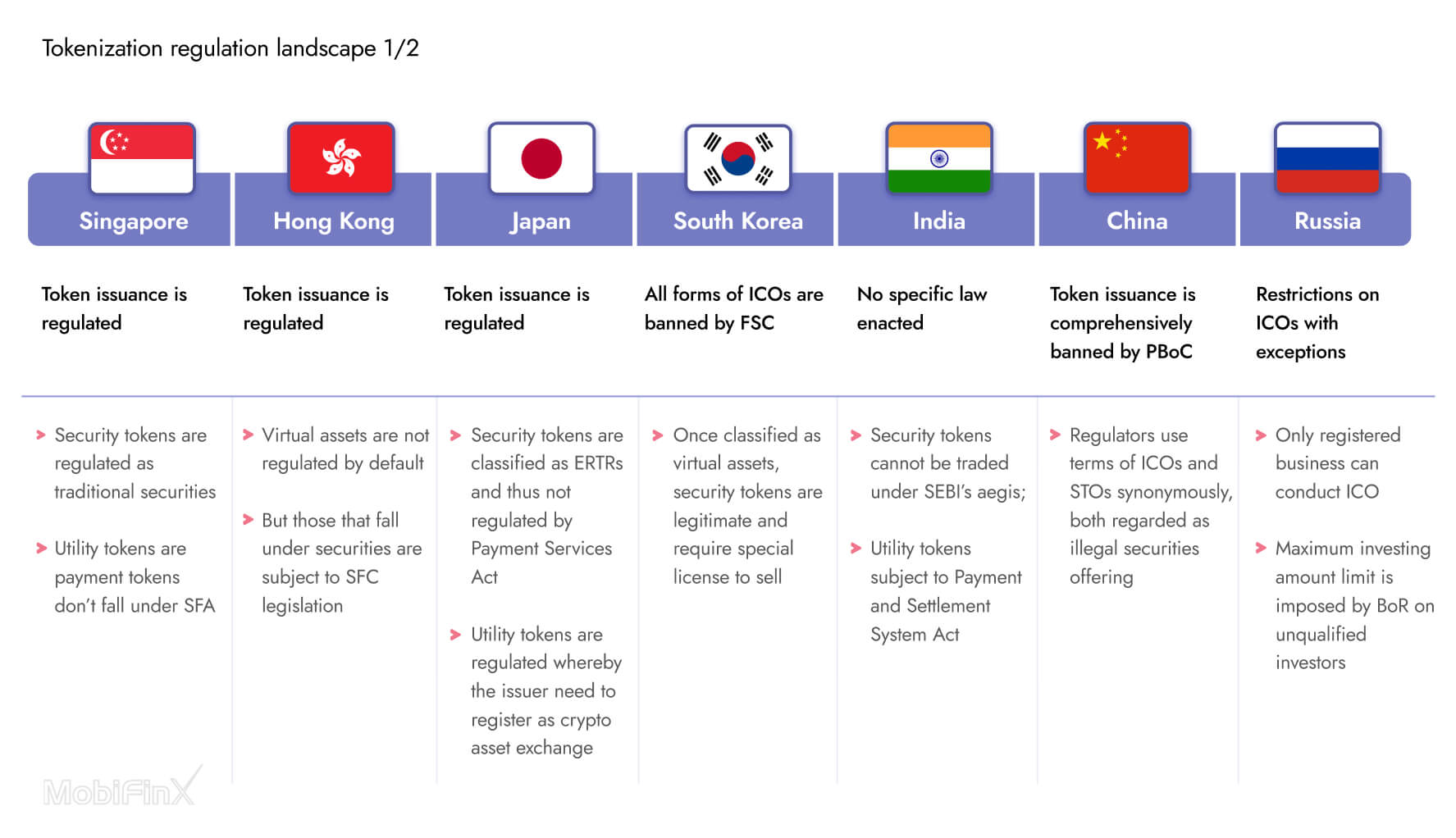

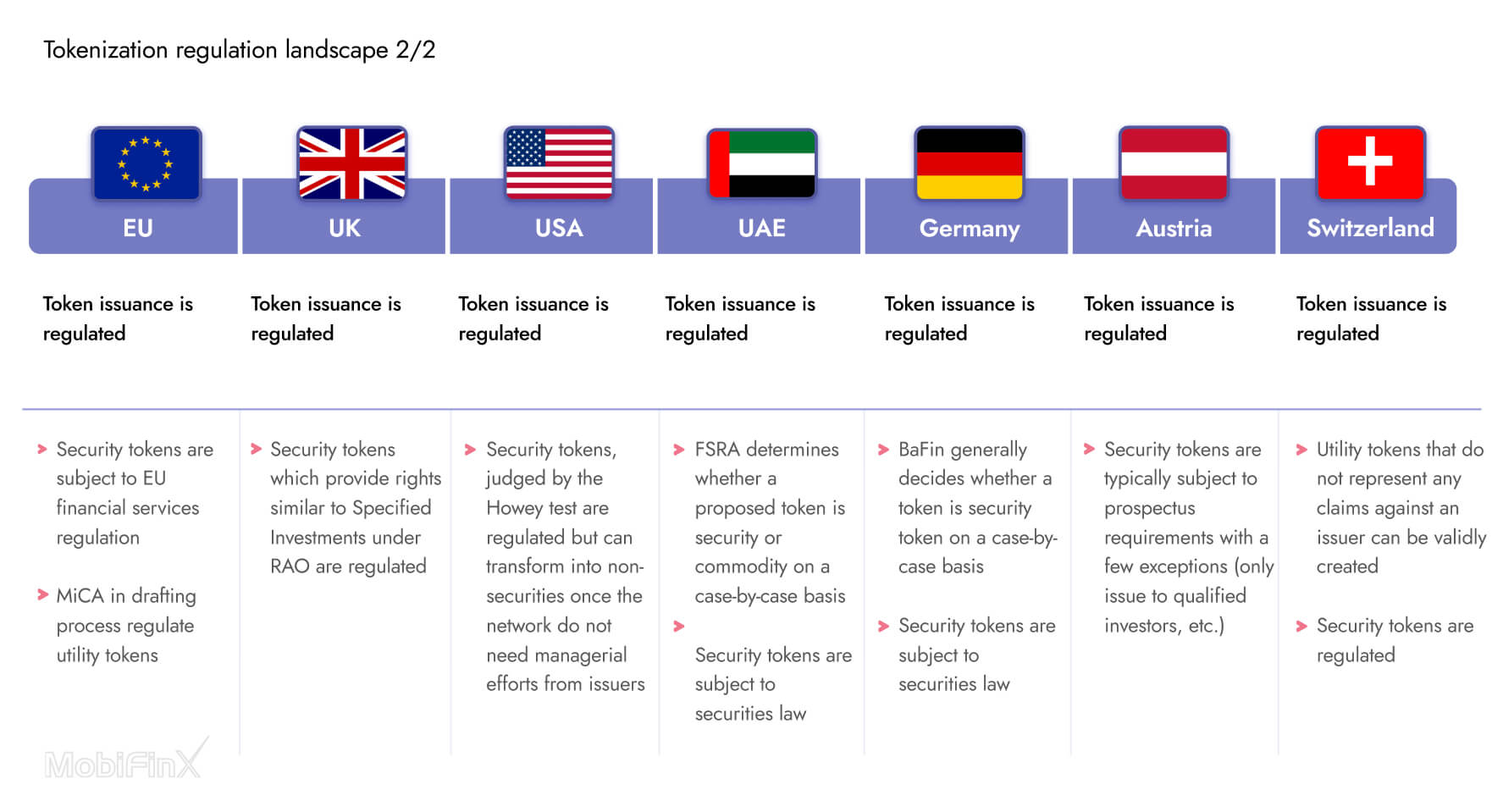

Regulatory Landscape of Asset Tokenization

Asset tokenization is revolutionizing the way we look at finances. It has brought more liquidity and inclusivity. But there’s more to this than meets the eye. With the advent of tokenization, digital assets are becoming complex commodities that require a regulatory framework.

Dr. Karl Michael Henneking from Untitled INC and Distributed Economy Think Tank and Blockchain Venture Launchpad believes that proper regulation can help unlock the full potential of the asset tokenization industry. According to him, a modern regulatory framework will be beneficial for the market, particularly for financial institutions and institutional investors, as it will remove one of the major barriers to entry into digital asset markets.

The current regulatory framework was designed for traditional securities, and its application to new asset classes, such as tokenized assets, remains unclear. Some countries, such as Austria and Luxembourg, have taken a cautious approach and are conducting assessments to ensure compliance with regulations. Other countries, such as Germany, Malta, and Liechtenstein, are taking a more proactive approach and are creating a dedicated regulatory framework for the token economy.

In January 2020, Liechtenstein became the first country with comprehensive guidelines with the implementation of the Blockchain Act. In September 2020, Germany published a draft of the Electronic Securities Act, which establishes a legal framework for issuing electronic securities on distributed ledger technologies.

However, some countries, such as Turkey, are still in the process of defining their regulatory approaches. The Turkish government is expected to release a regulatory framework for tokenized assets this year, which may require local hosting of infrastructure and add complexity for new players, potentially slowing down adoption.

Similarly, in the United States, the Securities and Exchange Commission (SEC) has classified most tokenized assets as securities, which means they are subject to federal securities laws. This includes initial coin offerings (ICOs) and security token offerings (STOs). The SEC has also emphasized the importance of proper disclosure and investor protection in the tokenization process.

In the European Union, the regulatory framework for asset tokenization is largely provided by the EU’s Prospectus Regulation and the Markets in Financial Instruments Directive (MiFID). These regulations aim to ensure investor protection and market efficiency.

In Asia, the regulatory landscape for asset tokenization varies widely. For example, in Japan, digital tokens are recognized as a means of payment and are regulated under the Payment Services Act. In contrast, China has taken a more cautious approach and has imposed strict regulations on cryptocurrency trading and initial coin offerings.

As the asset tokenization industry advances, the importance of custodians to protect the assets becomes increasingly crucial. However, it’s important for market participants to stay informed about the latest developments in their jurisdiction.

Real-world use cases (applications) of asset tokenization

Real estate

- What Is Tokenization Of Real Estate?

Tokenization of real estate refers to the process of converting ownership rights to a real estate asset into digital tokens on a blockchain. This allows the asset to be fractionally owned, bought and sold in a secure, transparent and efficient manner. Instead of owning a physical asset, the token holder owns a proportional share of the real estate asset as represented by the token. Tokenization also enables real estate assets to be easily traded and invested in, providing an alternative investment opportunity for investors.

- How Real Estate Tokenization Works ?

1. Real estate is divided into small ownership fractions or tokens

2. The tokens are issued as digital assets and placed on a blockchain

3. Investors can purchase tokens, representing fractional ownership of the real estate asset

4. Tokens are tradeable on a secondary market, allowing for easy transfer of ownership

5. Tokenization can improve liquidity and access to investment opportunities in real estate

6. The blockchain provides a secure and transparent record of ownership and transactions.

- Benefits Real Estate Tokenization

- Boosts Liquidity : Tokenization makes real estate investment more accessible by allowing assets to be fractionalized, thereby increasing liquidity.

- Widens the Investor Pool : Real estate tokenization opens up investment opportunities to a larger pool of investors by making it possible to sell, buy or hold assets from anywhere in the world with an internet connection and sufficient capital.

- Improved Transparency & Lower Transactions Costs : oBy recording every detail of a transaction in a secure digital token, there is complete transparency between the buyer and seller. Additionally, with fewer intermediaries and reduced administrative work, the process of buying and selling real estate becomes less expensive.

- Impeccable Proof of Ownership : oTokenization provides an immutable proof of ownership through the use of blockchain ledger, which eliminates any possible doubts about the validity of past or current transactions.

- Streamlined Property Management : Real estate tokenization makes it possible to register documents, receive timely rents from tenants, syndicate loans, and speed up the due diligence process through the use of blockchain-based smart contracts or tokens.

Finance

- What Is Tokenization of Finance?

Finance tokenization is the process of converting traditional financial assets into digital tokens on a blockchain, improving their efficiency, security, and accessibility for investment. It allows for division of assets into smaller units, reduces intermediaries and costs, and opens up investment opportunities for a wider range of people. Tokenization has the potential to revolutionize traditional finance.Asset tokenization has the potential to revolutionize the finance sector by solving various challenges that the industry has been facing. Here are some of the key ways in which asset tokenization can address these challenges:

- Regulatory framework : The financial sector is heavily regulated, and many regulations have been put in place to protect consumers and prevent financial crimes. Asset tokenization provides a secure, transparent, and tamper-proof way to track and manage assets, which helps to ensure regulatory compliance.

- Cyber security : The financial sector is also vulnerable to cyber threats, including hacking and data breaches. Asset tokenization provides a secure platform for the management of assets and financial transactions, reducing the risk of cyber-attacks and data breaches.

- Scalability : The financial sector is constantly evolving, and new technologies and products are introduced regularly. Asset tokenization offers a scalable and flexible platform for the creation and management of assets, allowing financial institutions to quickly adapt to changing market conditions and customer demands.

- Adoption : Despite the many benefits of asset tokenization, it is still a relatively new technology in the financial sector. Encouraging the adoption of asset tokenization will require education, awareness, and support from financial institutions, regulators, and consumers. By working together, the financial sector can help to drive the widespread adoption of this promising technology and reap its many benefits.

- How Finance Tokenization Works?

Finance tokenization works by converting traditional financial assets, such as stocks, bonds, real estate, and more, into digital tokens stored on a blockchain. These tokens represent ownership of the underlying asset and can be traded and managed in a decentralized manner.

- The process typically involves the following steps

- o The asset is evaluated and a fractional ownership model is established.

- o The asset is divided into smaller units, known as tokens, which can be bought and sold.

- o The tokens are issued on a blockchain and recorded in a smart contract, which automatically executes trades and tracks ownership.

- o Investors can buy and sell the tokens on a trading platform or marketplace, just like any other tradable asset.

- Benefits of finance asset tokenization are:

- 1. Diverse Investor BaseTokenization of finance assets has helped to expand the pool of investors from being limited to a small number of wealthy individuals to a larger and more diverse group. This allows for greater participation from retail investors and smaller financial institutions, increasing the overall demand for these assets.

- 2. Broader geographical reachAsset tokenization has made it possible for investors from all over the world to participate in the market, regardless of their location. This has resulted in a more global reach for these assets, and the possibility of capturing new sources of capital and liquidity.

- 3. Increase In The Available CollateralBy breaking down large, illiquid assets into smaller, tradeable tokens, tokenization increases the available collateral that can be used in financial transactions. This results in a higher degree of liquidity and a more secure financial system, as there is a greater amount of assets available to back up these transactions.

- 4. Infrastructure UpgradeAsset tokenization relies on advanced technology, including blockchain and smart contracts, which offers increased transparency, security and efficiency. The use of these technologies leads to an infrastructure upgrade that benefits all stakeholders, from issuers to investors.

Digital payments

- What Is Digital Payment Tokenisation?

Digital payment tokenization is the process of replacing a sensitive data element, such as a credit card number, with a unique identifier or “token”. This token is used to process payments in a secure manner without exposing the actual sensitive data. The tokenization process helps to reduce the risk of sensitive data being stolen or misused during a transaction.This makes digital payments more secure and helps to ensure regulatory compliance by adhering to security standards and protocols. The ease of transactions is also improved as tokens can be stored and used for multiple transactions, eliminating the need for repetitive input of sensitive data. Additionally, the use of tokens can reduce instances of fraud as tokens are less likely to be used for fraudulent purposes compared to actual sensitive data.

- How Digital Payment Tokenization Works?

Digital payment tokenization works by replacing sensitive payment information, such as a credit card number, with a unique token. This token represents the original payment information and is used for transactions instead of the actual payment information.

- The process typically involves the following steps:

- o The customer enters their payment information into a secure payment form.

- o The payment information is encrypted and sent to the tokenization service provider.

- o The tokenization service provider generates a unique token that represents the payment information.

- o The token is stored in the merchant’s payment system, replacing the sensitive payment information.

- o When the customer makes a subsequent purchase, the token is used to complete the transaction instead of the original payment information.

- How Asset Tokenisation Is Benefiting the Digital Payments Industry?

- 1. Data Protection and Security

The use of blockchain technology in asset tokenization provides a secure and transparent platform for digital payments. This helps to ensure that all transactions are protected against hacking and fraud, as the data stored in the blockchain ledger is immutable and cannot be tampered with. This creates a much higher level of security compared to traditional payment methods, and helps to protect the personal and financial information of users.

- 2. Regulatory Compliance

With the increasing use of digital payments, there is a growing need for financial institutions to comply with strict regulations and security standards. Asset tokenization helps to ensure that all transactions are compliant with regulatory requirements, as the blockchain platform provides a secure and transparent platform for recording and tracking all transactions. This helps to reduce the risk of regulatory violations and ensure that financial institutions are able to operate in a safe and secure environment.

- 3. Ease of TransactionsThe use of asset tokenization in digital payments can greatly simplify and speed up the transaction process, as it eliminates the need for intermediaries and reduces the amount of paperwork and administrative work involved. This allows users to send and receive payments in real-time, with the added security and transparency of blockchain technology.

- 4. Fraud ReductionFraud is a major concern in the digital payment space, and one that is becoming increasingly difficult to prevent. Asset tokenization helps to reduce the risk of fraud by using blockchain technology to provide a secure and transparent platform for recording transactions. This helps to eliminate the risk of unauthorized transactions and reduces the potential for fraudulent activities. Furthermore, the use of smart contracts and other blockchain-based tools can help to automate the payment process and reduce the risk of human error, further reducing the potential for fraud.

Healthcare

- What Is Tokenization of Healthcare?

Asset tokenization in the healthcare industry offers numerous benefits, such as increased efficiency, improved transparency, reduced costs, and enhanced security. Tokenization enables the digitization of medical assets and the creation of digital tokens that represent ownership of these assets. This allows for more efficient and secure transfers of ownership and reduces the need for intermediaries. Additionally, the use of blockchain technology in tokenization provides a tamper-proof, transparent, and secure record of all transactions. The healthcare industry can greatly benefit from the increased efficiency, cost savings, and improved security offered by asset tokenization.

- How Healthcare Tokenization Works?

Healthcare tokenization works by converting sensitive healthcare information, such as patient records, into digital tokens that are stored on a blockchain. These tokens are used to manage, transfer, and access the underlying information in a decentralized manner securely and privately.

- The process typically involves the following steps :

- o Patient healthcare information is collected and stored in a secure database.

- o The information is encrypted and divided into smaller, unique tokens that represent the underlying information.

- o The tokens are stored on a blockchain, providing a secure and transparent record of the information.

- o The tokens can be used to grant access to authorized parties, such as healthcare providers, insurers, and researchers, in a secure and privacy-preserving manner.

- Benefits of using asset tokenisation in healthcare are:

- 1. Secure Data Management

Tokenization provides a secure and tamper-proof way of storing sensitive medical information and records. The use of blockchain technology ensures the confidentiality and privacy of data, making it difficult for unauthorized users to access or manipulate it.

- 2. Streamlined Processes

Asset tokenization streamlines various processes in the healthcare industry, such as medical record-keeping, payment processing, and supply chain management. This can help reduce the time and cost associated with manual processes, leading to improved efficiency and productivity.

- 3. Improved Access to HealthcareTokenization makes it possible to share and exchange medical data and information between healthcare providers and patients in a secure and seamless manner. This can help improve patient care and outcomes, especially for those living in remote areas with limited access to healthcare facilities.

- 4. Better Fund ManagementTokenization allows for the creation of secure and transparent financial instruments, such as tokens that represent healthcare investments or funding initiatives. This can help reduce the risk of fraud and increase the accountability of healthcare organizations, resulting in better and more effective use of funds.

- 5. Enhanced CollaborationTokenization enables different healthcare organizations and stakeholders to collaborate and exchange data and information in real-time, helping to improve patient outcomes and overall healthcare delivery.

Art

- What Is Tokenization of Art?

Asset tokenization helps the art industry by providing a new way for artists and collectors to buy, sell, and trade art. By converting physical art assets into digital tokens, artists and collectors can more easily and securely trade their art, making it more accessible to a wider range of people. Asset tokenization also provides artists with greater control over the distribution and sale of their work and helps to reduce fraud and counterfeiting by providing a secure and transparent record of ownership. Additionally, asset tokenization can provide more opportunities for artists to monetize their work, and for collectors to invest in high-quality art assets.

- How Art Tokenization Works?

Art tokenization works by converting ownership rights in physical or digital artwork into digital tokens stored on a blockchain. These tokens represent fractional ownership in the artwork and can be bought, sold, and traded in a decentralized manner.

- The process involves the following steps :

- o Art tokenization converts artwork ownership into digital tokens stored on a blockchain

- o Evaluate the artwork and establish a fractional ownership model

- o Divide the artwork into smaller units, called tokens, each representing a specific percentage of ownership

- o Record the tokens on a blockchain through a smart contract, which manages trades and tracks ownership

- o Investors can trade the tokens on a marketplace, like other tradable assets.

- Benefits of Art Tokenization :

- 1. Accessibility

Enables wider participation in the art market, allowing investors to buy and sell fractional ownership in artworks.

- 2. Liquidity

Increases the liquidity of art investments by enabling the efficient and secure transfer of ownership.

- 3. Transparency

Provides a secure and permanent record of ownership, reducing the risk of fraud and counterfeiting.

- 4. Efficiency

Reduces the need for intermediaries and simplifies the process of buying and selling art, improving efficiency and reducing costs

- 5. Inclusiveness

Provides a more equitable and inclusive art market, benefiting artists, collectors, and investors alike.

- 6. Security

Utilizes blockchain technology to enhance the security and privacy of sensitive information, such as ownership rights and transaction details.

- 7. Traceability

Provides a permanent and tamper-proof record of the history of an artwork, including ownership and sales transactions.

- 8. Innovation

Supports the development of new business models and investment opportunities in the art market.

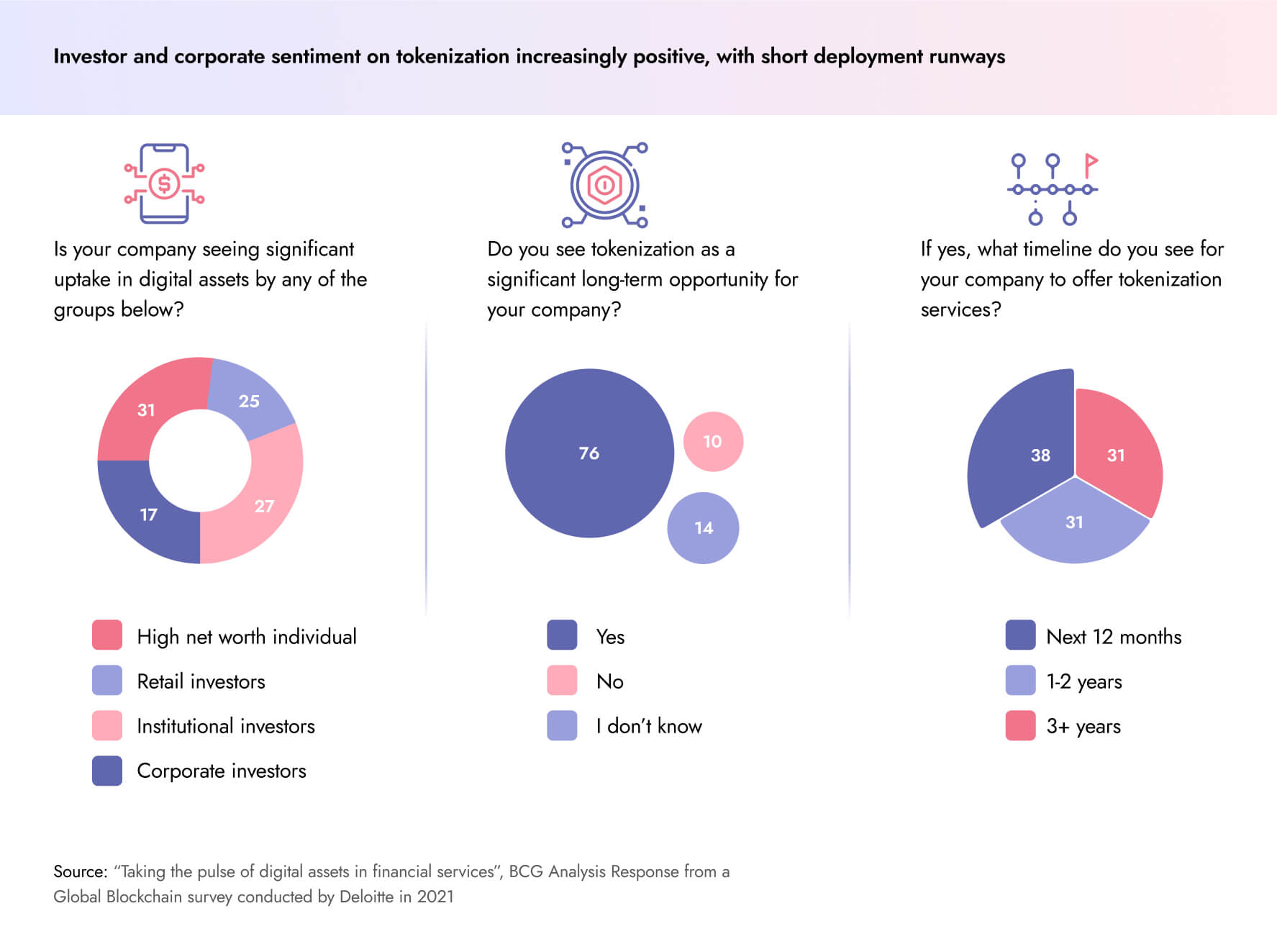

Why are Businesses choosing asset Tokenization?

A report by global consulting firm BCG and ADDX shows that Asset tokenization will grow 50-fold to expand into a $16.1 trillion business opportunity by 2030. The projected growth of asset tokenization is driven by demand from several investors who want a deep access to private markets.

With that being said, in today’s times, retail companies have access to multiple payment options beyond just in-store transactions via point of sale (POS) systems. Consumers can now buy goods and services through phone calls, mobile applications, and online shopping sites. However, this convenience carries the risk of cyber threats such as credit card fraud and data breaches, which hampers business’s sales. Hence, asset tokenization comes to the rescue. Here are the following reasons why businesses are choosing tokenization:

1. Liquidity : Tokenization can provide increased liquidity for assets that were previously illiquid, allowing for more efficient and cost-effective trading.

Accessibility: Tokenization enables fractional ownership of assets, making it possible for a wider range of individuals to invest in and own a share of valuable assets.

2. Security : Tokenization is based on blockchain technology, which offers a secure and transparent platform for asset trading. Digital tokens are tamper-proof and can be securely transferred and stored.

3. Ease of Transfer : The use of digital tokens in tokenization makes it easier to transfer ownership, as compared to traditional methods which can be cumbersome and time-consuming.

4. Automation : Tokenization can automate and streamline various processes, such as trading and settlement, reducing the risk of errors and saving time.

5. Cost Reduction: Tokenization can reduce costs associated with intermediaries and increase efficiency in asset trading.

7. Fractional Ownership: Fractional ownership using tokenization allows small investors to benefit from ownership and investment opportunities previously only available to larger investors, leading to greater financial inclusivity, increased funding and liquidity.

6. Compliance : Tokenization can help businesses comply with various regulations and reporting requirements in a cost-effective and transparent manner.

8. Go-To-Market Time Reduction : Tokenization reduces Go-To-Market Time to bring a product and helps businesses speed up launch and drive higher profits.

Here the second part of the three-part series on asset tokenization on blockchain. In the next part, we’ll the benefits of asset tokenisation, key challenges, how to invest in tokenized assets and so on.

mobifinxadmin